Debt Knowledge Series

A Primer on Sustainability-Linked Loans

Answers to frequently asked questions about the structure and mechanics of sustainability-linked loans.

Jan 23, 2023

Introduction

Terminology

FAQs on Sustainability-Linked Loans

Introduction

Across corporate finance, lenders and borrowers alike face increasing pressure to respond to environmental, social, and governance (ESG) concerns. The pressure comes both from regulatory mandates as well as less compulsory suasion emanating from clients, investors, employees, and other stakeholders. This paper provides an introduction to sustainability-linked loans (SLLs), which have emerged in response to ESG considerations in the syndicated loan space.

Through the carrot of lower interest, SLLs reward borrowers that hit ESG-related targets tailored to their line of business. For example, a car manufacturer that makes its factories more energy efficient, as verified by an annual audit, secures an interest rate reduction for the following year of the loan period. Many SLLs also contain disincentives, with interest rate increases applied for poor ESG performance.

After a rapid increase in the issuance of loans with sustainability incentives in recent years, volumes moderated in 2022 for the first time in response to higher interest rates and an uncertain economic outlook. Some issuers may have also waited for the industry to settle on more established standards before entering the market. Still, despite the slight recent slackening, in the six years since the first pioneering SLLs were launched, the pace of innovation has been as vigorous as the secular growth of the overall market.

This paper adopts an FAQ format, with the first few questions covering statistics and trends about the overall market for SLLs before turning to legal and procedural matters.

Terminology

Before diving into the FAQs on the following page, we’ll first define two important terms - Key Performance Indicators (KPIs) and Sustainability Performance Targets (SPTs) - used to detail the sustainability aspects of a loan.

A KPI describes a measurable ESG variable. For example, in the cosmetics industry, the share of recyclable plastics used in a company’s packaging represents a common KPI.

An SPT sets a numerical benchmark tied to the KPI, along with a deadline. The borrower needs to hit the target to capture the interest rate discount. For the above KPI, the SPT might be defined as: “More than 20% of total packaging must consist of recyclable plastic by May 2025”.

KPIs and SPTs function as a dyad, with each KPI containing a linked SPT. Here are two real-world examples of KPIs and SPTs taken from recently issued SLLs:

Enel S.p.A. [Itailan Energy Firm] 2020 €1 billion 6-Year SLL

KPI: Percentage of power capacity from renewable sources

SPT: 60% of power capacity must come from renewable sources by December 2026

Carlyle Group 2021 $4.1 Billion 3 Year Credit Line

KPI: Minority representation on the boards of the firm’s portfolio companies

SPT: 30% of board members of portfolio companies must consist of minorities by 2024

FAQs on Sustainability-Linked Loans

When were the first SLLs launched?

Phillips, the Dutch-based health technology company, issued the first SLL in April 2017. After their advent in Europe, SLLs soon spread to other regions. Asia (March 2018), the US (June 2018), and Latin America (July 2019) all saw their first SLL issuances before the end of the last decade.

SLLs are quite young. What practical effect does their relative immaturity have?

Because SLLs are so young, best practices are less defined than in more established areas of finance. Without a long-standing track record of completed deals to refer to, debt actors have demonstrated a willingness to experiment with new structures and methods. As SLLs proliferate to new industries with their own unique set of applicable KPIs, experimentation is likely to continue apace.

How common are SLLs? What percentage of leveraged loans contain sustainability incentives?

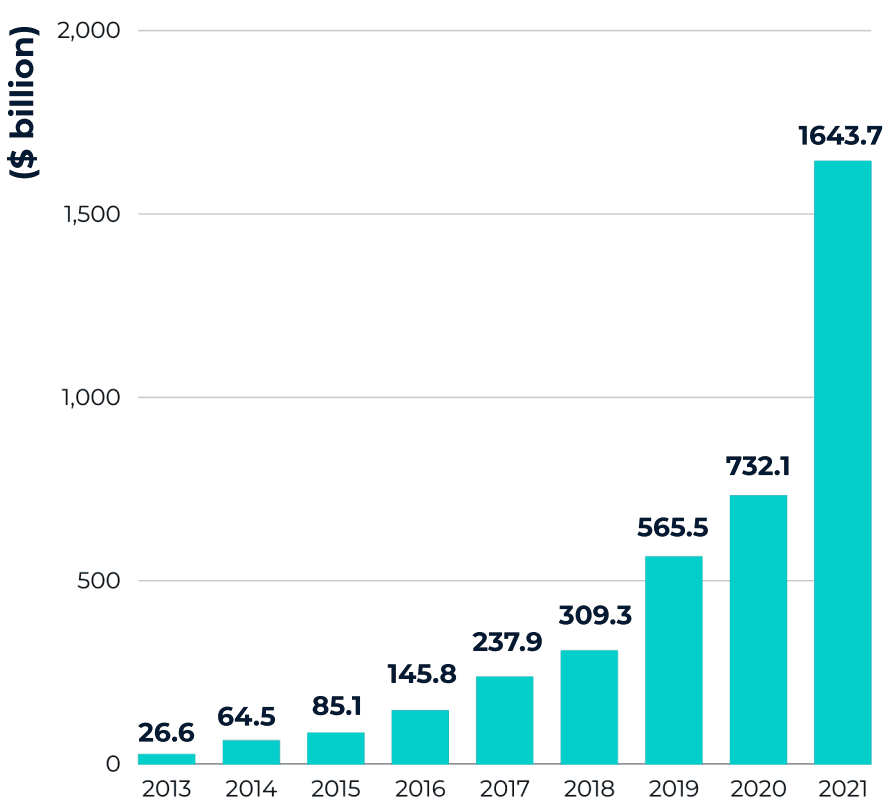

SLL issuance had surged across all sectors and regions in recent years. According to Refinitiv, the dollar volume of syndicated loans with sustainability clauses rose more than 300% in 2021, reaching a worldwide total of $717 billion.

SLLs are most common in Europe, where regulations surrounding ESG in general, and climate change more specifically, are strongest. In 2021, over 40% of leveraged loans in Europe contained interest rate incentives for achieving ESG goals. Although starting from a smaller base, uptake has occurred rapidly across North America, Asia, and Latin America, as well.

The data below from BloombergNEF show the remarkable growth through 2021 across all sectors of sustainable debt, including both bonds and loans. However, according to early indications, volumes will likely decline for the first time in 2022 in response to interest rate hikes, business cycle uncertainty, and perhaps the increased scrutiny being directed at ESG initiatives. It remains to be seen whether the expected drop in SLLs outpaces a similar expected decline in the overall leveraged loan market.

Figure 1: Annual Sustainable Debt Issuance, 2013-2021

Must SLLs be used to finance green projects?

No. Unlike green loans, which must be directed towards specific sustainable objectives (e.g., converting a coal plant to natural gas), SLLs can be used for any purpose the borrower sees fit, including general corporate expenditures.

SLLs delink the borrower’s use of proceeds from the borrower’s effort to achieve ESG goals. Many businesses, especially those outside the energy industry, lack large-scale stand-alone green projects they can readily package and present to lenders. SLLs have therefore enabled sustainable finance to expand to a much larger field of borrowers.

SLLs have also enlarged the types of KPIs that can be addressed. Several ESG initiatives – especially those that fall under the “S” and “G” of ESG, such as increasing minority representation – are not particularly capital-intensive and cannot absorb funds on the same scale as a typical environmental project.

What are some examples of common KPIs?

Common KPIs include metrics related to:

Renewable energy usage

Recyclable input usage

Green buildings

Waste output and pollutant emissions

Water or electricity consumption

Workforce diversity

Workplace safety

Although the majority of KPIs tend to be linked to environmental concerns, especially carbon intensity, social issues are also frequently addressed, and may become more prevalent in coming years as more robust measurement frameworks come to be adopted. Workers’ rights, health & safety, job creation, minority representation in leadership positions, and supply chain issues are among the top social indicators integrated into SLLs.

How many KPIs are included in the typical SLL?

One to five is typical. As ever, there are outliers. A 2019 loan issued by the French retailer Carrefour contained 17 KPIs.

What happens if a borrower only succeeds in fulfilling some, but not all of the SPTs?

SPTs do not typically operate on an all-or-nothing basis. An SLL with four SPTs, for example, might handle intermediate performance situations in a number of different ways. In one type of structure, the borrower receives separate, cumulative discounts for each SPT. A borrower that only hits one out of four SPTs would receive a relatively modest interest rate cut, with further discounts accorded for each additional goal attained.

In another type of incentive structure, the borrower might only need to meet three of the four targets to achieve the full discount. However, no piecemeal discounts would be granted for achieving only one or two targets. To reiterate, experimentation is evident across all ESG-related provisions, including interest rate adjustments. These two examples illustrate just some of the variety exhibited in the market.

Do SPTs remain static throughout the duration of the loan? Do borrowers need to show annual improvement?

There is no standard. Some SPTs require borrowers to demonstrate annual improvements, while other SPTs remain flat, with the same thresholds in effect throughout the duration of a loan.

How often are SPTs assessed?

SPT performance reviews are typically conducted annually with an interest rate adjustment that applies to the following year until the next review.

How big is the size of the interest rate adjustment?

The total interest rate adjustment possible, assuming all SPTs are met, typically falls within the range of .04% to .10%. Outliers with higher discounts (and penalties) do exist, with .25% as an upper bound seen in practice. Interest rate adjustments lower than .04% do occur but run the risk of inviting criticism. With such slight penalties and rewards at stake, the effort to incorporate ESG provisions becomes drained of impact and meaning. We examine this point further in the discussion on greenwashing below.

How are ESG-related clauses codified within the debt agreement?

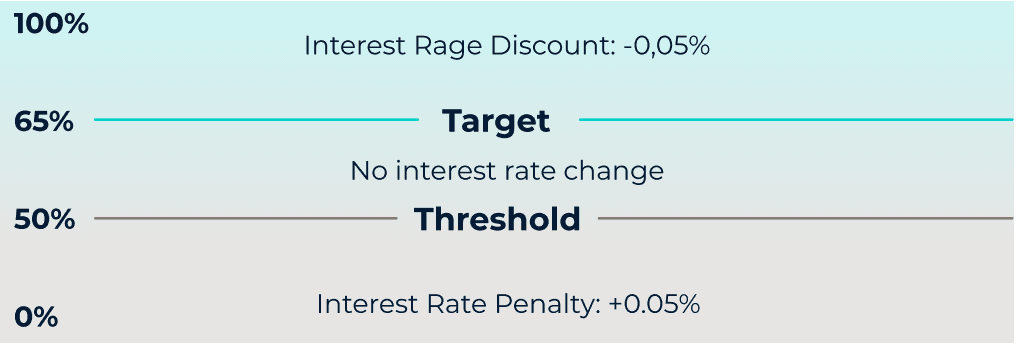

Below is a clause taken from a computer manufacturer’s debt agreement outlining the interest rate adjustment. In this example, good performance gets rewarded (minus 0.005%), poor performance is penalized (additional 0.005%), and middling achievement sees the baseline interest rate unchanged. This language is represented graphically in Figure 2 below.

Renewable Electricity Fee Adjustment Amount” means (a) positive 0.005%, if the Renewable Electricity Percentage is less than the Renewable Electricity Percentage Threshold (50%), (b) 0.000%, if the Renewable Electricity Percentage is more than or equal to the Renewable Electricity Percentage Threshold (50%) but less than the Renewable Electricity Percentage Target (65%), and (c) negative 0.005%, if the Renewable Electricity Percentage is more than or equal to the Renewable Electricity Percentage Target (65%).

In the language of a debt agreement, “threshold” refers to the mark beneath which a penalty gets applied and “target” refers to the mark above which an interest rate discount gets awarded.

Figure 2: Interest Rate Adjustment Based on % of Electricity From Renewable Sources

There is much variety surrounding incentive packages. Some SLLs do not contain any disincentives (all carrot; no stick), while others consist solely of disincentives (all stick; no carrot). In the latter case, the best-case scenario for a borrower that meets all its STPs is the avoidance of penalties.

For borrowers that fail to meet an STP threshold, are there any additional penalties aside from an interest rate increase?

Unlike financial covenants, failure to hit a sustainability-driven KPI does not result in loan default. At worst, the borrower incurs the interest rate penalty and perhaps the right to publicly describe the loan using ESG-related language.

How are KPIs chosen? How are SPT thresholds calibrated? How are interest rate adjustment levels determined?

Counterparties consider several factors when building out ESG-related clauses. KPIsneed to be relevant. A KPI for a canned tuna producer, such as installing monitoring devices on boats to ensure fishing occurs in sustainable waters, will differ from the indicators applied to a software firm.

SPTs should be ambitious. They should not represent improvements a borrower would likely undertake in the regular course of business. For example, a clothing manufacturer that in recent years has been reducing its use of water by an average of 2% a year without an SLL in place should be required to secure more aggressive cutbacks. On the other hand, SPTs should not be pitched too high, either. A borrower might abandon efforts to meet an SPT if it recognizes it does not have a reasonable chance of reaching the target.

When setting SPTs, loan parties review the borrower’s recent performance on the proposed KPIs, the performance of industry peers, and any applicable guidelines set by national or international regulatory bodies. It is of course easier to identify appropriate targets when SPTs are based on factors that the borrower has already been measuring.

Interest rate adjustments should be high enough to properly incentivize the borrower to take actions it might not otherwise take. However, potential adjustments that are too large could dissuade lenders from participating.

Merely acknowledging these many trade-offs doesn’t make striking the right balance easier. Experimentation abounds as SLL actors strive to fine-tune terms that satisfy all loan parties while yielding meaningful ESG benefits.

Are there reputational risks that loan parties should consider?

Taken together, the package of clauses should be crafted so that satisfying the targets significantly improves the overall ESG profile of the borrower. If they aren’t crafted in such a manner, parties to the loan risk being accused of “greenwashing”, or using the SLL as a public relations exercise that fails to effect real change. Irrelevant KPIs, or SPTs and interest rate adjustments that are too modest may invite these accusations.

Who manages ESG-related aspects of the SLL?

The sustainability coordinator (SC), also known as the sustainability structuring agent, manages sustainability-related provisions of the loan. A bank in the lender group typically fills the role.

In the pre-signing negotiation period, the SC works in concert with multiple debt parties to settle on KPIs, SPTs, and interest rate adjustment levels. Since individual lenders in the lending group will each have their own unique corporate ESG policies, the SC attempts to bring lenders into alignment and helps them understand the potential impact of the interest rate adjustments on their operations and bottom line. With the borrower, the SC can provide guidance on report preparation. Finally, the SC might weigh in with lawyers regarding the legal documentation of the ESG-related clauses.

Post-signing, the focus turns to monitoring the borrower’s performance. In many cases, external auditors take over the lion’s share of the duties here, with the bank that was appointed to serve as SC playing a less prominent role. Although many loans rely upon the borrower to self-verify their performance, the push emanating from lenders is for increased use of independent, third-party auditors.

During the negotiation phase prior to signing, an external auditor may also be called upon to validate the suitability of the proposed sustainability terms.

Debt Knowledge Series

An Introduction to Debt Agreements for Leveraged Loans

A section-by-section breakdown of the sometimes confounding debt agreements that govern leveraged loans.

Feb 1, 2023

Debt Knowledge Series

An Introduction to Covenants in Leveraged Finance Debt

A review of various covenant types and the ongoing tug-of-war between counterparties over the stringency of covenant terms.

Jan 6, 2023

Debt Knowledge Series

Corporate Bonds Are Not For Beginners

An experiment in buying corporate bonds through the biggest retail brokerage firms.

Feb 15, 2023